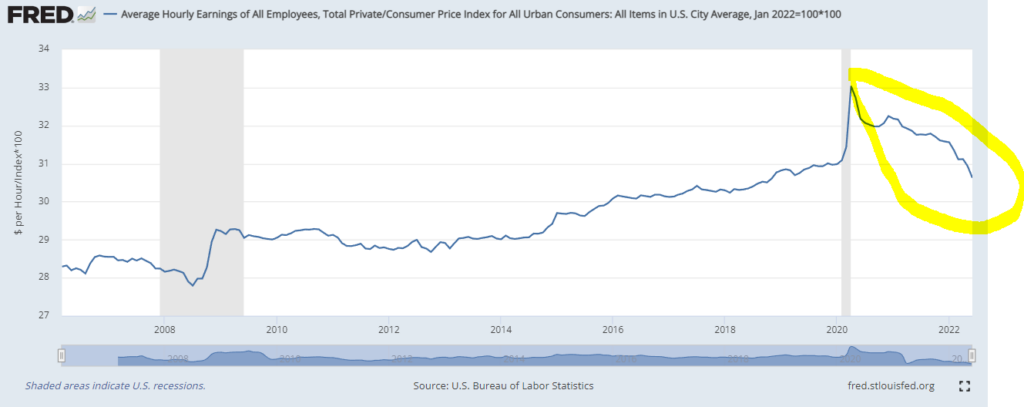

Every month the news brings us reports that inflation has reached a new high for this century, and as of the end of June the Consumer Price Index has risen 9.1% over the past year. What hasn’t been reported is that workers’ wages haven’t kept pace with increases in prices, and workers have in fact lost 7.9% of their purchasing power since April 2020, when the Federal Reserve Bank started printing money like we were Zimbabwe or Venezuela.

According to the US Bureau of Labor Statistics, workers saw a “4.4-percent decrease in real average weekly earnings” in the last 12 months alone. That slide will probably continue, as inflation continues upward toward its peak level (probably some time next year).

This trend brings us to four questions (with answers):

(1) Why are workers’ wages buying less? (2) Why does inflation negatively impact the purchasing power of workers’ wages?

Workers have more dollars than ever, but can’t buy nearly as much as they did two years ago because they have a smaller share of the dollars that are in circulation. The Federal Reserve Bank increased the money supply between April 2020 and today by 40%, but workers wages rose by less than 7% during that time period. When the Federal Reserve Bank creates new money, the financial sector gets that money first, and buys up all the assets before the prices rise to a new, higher level. Those without the new money lose purchasing power.

Also, as prices rise, inflation helps debtors (like banks) and hurt creditors. It may sound strange to think of the working poor to be creditors, but every laborer credits his employer with a week or two of wages, just as every renter credits his landlord with an advance on his rent. Moreover, workers also credit banks when they deposit their paychecks. The poorer a man is the more likely he is to be a creditor and the less likely he is to have enough credit to become a debtor.

(3) Why isn’t it being reported in the legacy media?

The legacy (or mainstream) media rarely reports how inflation hurts the poor for a number of reasons. A big part of it is economic ignorance. Another part of it is that many media outlets have been captured by the financial establishment that has been getting rich by skimming wages from the working poor through inflation since the gold standard was abolished in 1971. The Federal Reserve Bank, which is the quasi-private institution that creates the money digitally, has a revolving door with some of the most politically connected Wall Street investment firms, like Goldman Sachs, which is in turn connected with many of the legacy media institutions.

(4) What can I do about this robbery through inflation?

You can write your congressman and ask them to abolish — or at least publicly audit — the Federal Reserve Bank to expose their insider dealings on behalf of politically-connected Wall Street firms. The Federal Reserve Transparency Act of 2021 is sponsored by Thomas Massie (R-KY) in the House and by Senator Rand Paul in the Senate.

Also, you can get involved in your local Libertarian Party, which is committed to exposing this robbery of the poor and abolishing the Federal Reserve Bank.